Things about 501 C

Wiki Article

Google For Nonprofits Can Be Fun For Everyone

Table of ContentsThe Greatest Guide To Not For ProfitNot known Details About Non Profit The Best Strategy To Use For Irs Nonprofit SearchTop Guidelines Of Nonprofits Near Me501c3 Organization Can Be Fun For Everyone501c3 Nonprofit Can Be Fun For EveryoneIrs Nonprofit Search Things To Know Before You Get ThisThe 10-Minute Rule for Nonprofits Near Me

On the internet giving has actually grown throughout the years, and it maintains expanding. Unlike several other forms of giving away (via a telephone call, mail, or at a fundraiser occasion), contribution web pages are extremely shareable. This makes them optimal for increasing your reach, and therefore the variety of contributions. Donation web pages allow you to collect and also track data that can notify your fundraising method (e.donation sizeContribution when the donation was made, who donated, gave away much, how they just how to your website, web site) And so on, ultimately pages make web pages convenient and practical for easy donors to give! 8. 3 Create an advertising and also content plan It can be appealing to let your advertising and marketing establish organically, yet doing so offers more problems than advantages.

Be sure to gather email addresses as well as various other pertinent information in a proper means from the beginning. 5 Take care of your people If you have not tackled employing as well as onboarding yet, no concerns; now is the time.

8 Simple Techniques For Irs Nonprofit Search

Below's how a not-for-profit used Donorbox to run their campaign and also obtain contributions with a simple yet well-branded web page, optimized for desktop and mobile - non profit organization examples. Deciding on a financing design is vital when beginning a not-for-profit. It depends upon the nature of the not-for-profit. Below are the different kinds of financing you could want to take into consideration.As an outcome, nonprofit crowdfunding is grabbing the eyeballs these days. It can be made use of for certain programs within the organization or a basic contribution to the reason.

During this step, you may desire to think regarding milestones that will show an opportunity to scale your nonprofit. As soon as you have actually operated for a bit, it's crucial to take some time to think regarding concrete growth goals.

Excitement About Irs Nonprofit Search

Without them, it will certainly be hard to examine and also track progression later on as you will have absolutely nothing to determine your outcomes versus as well as you will not know what 'effective' is to your not-for-profit. Resources on Beginning a Nonprofit in different states in the US: Beginning a Not-for-profit FAQs 1. Exactly how much does it set you back to start a not-for-profit company? You can start a nonprofit company with a financial investment of $750 at a bare minimum and also it can go as high as $2000.How long does it take to establish a not-for-profit? Relying on the state that you remain in, having Articles of Unification approved by the state government may occupy to a few weeks. Once that's done, you'll need to look for recognition of its 501(c)( 3) status by the Irs.

With the 1023-EZ form, the handling time is generally 2-3 weeks. non profit start up Can you be an LLC and a not-for-profit? LLC can exist as a nonprofit minimal obligation company, nonetheless, it should be totally owned by a single tax-exempt nonprofit company.

See This Report about 501 C

What is the difference between a structure and a not-for-profit? Foundations are usually moneyed by a household or a corporate entity, however nonprofits are moneyed through their earnings and also fundraising. Structures typically take the money they started with, invest it, and afterwards disperse the money made from those investments.Whereas, the extra cash a not-for-profit makes are used as operating expenses to money the organization's objective. Is it tough to begin a not-for-profit company?

There are a number of actions to start a nonprofit, the obstacles to access are fairly few. Do nonprofits pay taxes? If your nonprofit earns any kind of revenue from unconnected activities, it will owe revenue taxes on that amount.

How 501c3 can Save You Time, Stress, and Money.

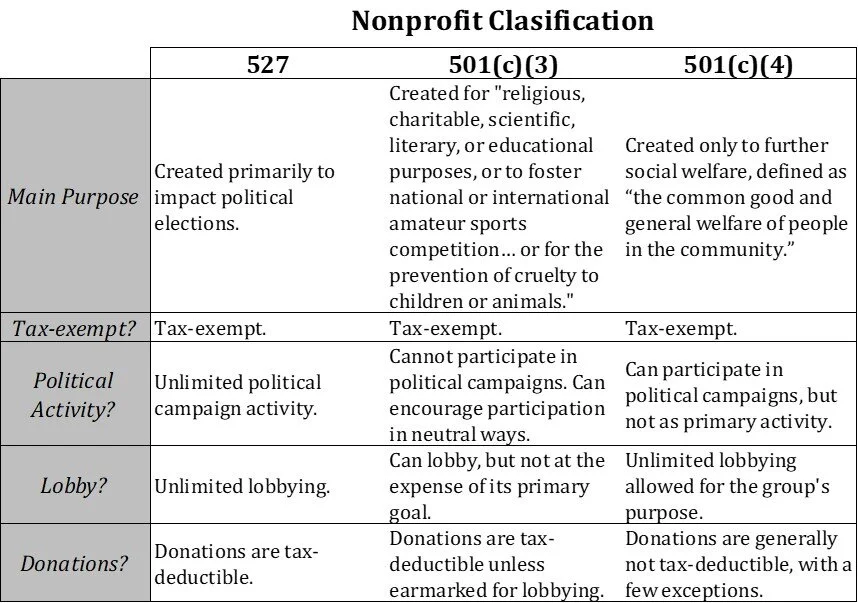

The function of a nonprofit company has constantly been to create social adjustment and also lead the method to a much better world., we focus on solutions that aid our nonprofits boost their donations.By much the most typical kind of nonprofits are Section 501(c)( 3) organizations; (Section 501(c)( 3) is the part of the tax code that licenses such nonprofits). These are nonprofits whose goal is charitable, religious, instructional, or clinical.

This category is vital because exclusive structures undergo stringent operating policies and also guidelines that do not relate to public charities. For instance, deductibility of contributions to a personal foundation is a lot more minimal than for a public charity, and also private foundations are subject to excise taxes that are not enforced on public charities.

The Only Guide to Not For Profit

The bottom line is that personal foundations get a lot worse tax therapy than public charities. The major distinction between exclusive foundations and public charities is where they get their financial backing. A private structure is typically controlled by an individual, family members, or company, and also gets a lot of its income from a couple of benefactors and also investments-- a good instance is the Bill and also Melinda Gates Foundation.This is why the tax regulation is so tough on them. The majority of structures just provide cash to various other nonprofits. Nonetheless, somecalled "operating structures"operate their very own programs. As a functional matter, you need a minimum of $1 million to begin a personal structure; or else, it's not worth the problem and expenditure. It's not unusual, then, that an exclusive structure has been called a large body of cash surrounded by people that want a few of it.

More About 501c3 Organization

If the IRS classifies the not-for-profit as a public charity, it maintains this status for its first five years, regardless of the general public support it actually gets throughout this time. Beginning with the not-for-profit's sixth tax year, it needs to show that it satisfies the general public assistance examination, which is based upon the assistance it obtains throughout the current year and previous 4 years.If a nonprofit passes the test, the IRS will certainly proceed to monitor its public charity status after the first five years by requiring that a completed Schedule A be you could try these out submitted every year. Figure out more regarding your not-for-profit's tax status with Nolo's book, Every Nonprofit's Tax Overview.

Report this wiki page